Updated 2/9/2022

Category Table

| Categoty | Card | Backup Card | Comment |

|---|---|---|---|

| Dining | BofA Dining – 4.5% | Freedom/it – 5% rotating | |

| Merchandise | BofA Online – 4.5% Ducks Unlimited – 5% (sporting goods) | AFCU – 5% HMBradley – 3% Venture X – 2x | In person & small go on AFCU, HMB if it is a large purchase |

| Travel | Venture X – 5x | BofA Online – 4.5% | Venture X on CapOne portal |

| Gas | Ducks Unlimited – 5% Albert- 20% | HMBradley – 3% | If I don’t have my Ducks card on me use HMB |

| Utilities | Max Cash Preferred – 5% | HMBradley – 3% | HMB if it is a large purchase |

| Amazon | Amazon Store – 5% | AFCU – 5% | Small go on AFCU |

| Wholesale | Albert – 20% Point – 5-10% Freedom/it – 5% rotating | BofA Dining – 3% | If a boost/category is available I’ll use it |

| Automotive | HMBradley – 3% | Venture X – 2% | If top cat is available use HMB |

| Catch All | BofA Premium – 2.25% AFCU – 5% | HMBradley – 3% | AFCU for charges >=$30 HMBradley for larger purchases |

Debit Cards

Atlantic Federal Credit Union

AFCU is a very small credit union in New Jersey that has a very restrictive footprint membership eligibility requirement

Kasasa Cash Back Checking – Visa – No AF

Kasasa accounts are a type of checking/savings account that credit unions/community banks can offer that have great rewards/benefits with no fees. I suggest looking in your area for banks/CUs that offer Kasasa accounts

Rewards

- 5% back on all purchases (max $200 spend) when requirements are met

I mainly use this card for miscellaneous smaller out of category spend

Requirements

- Enable e-Statements

- Have a direct deposit hit the account every month

- Make 12 debit transactions every month

Albert

Albert Debit – MasterCard – No AF

Rewards

- Changing “rewards” including 10% on Shell & WholeFoods, 20% on Costco, 15% on Chipotle etc, maxed at $5 cash back each

Square

Cash App Debit – Visa – No AF

Rewards

- Occasional “boosts” including 25% back on ShakeShack, 5% Bitcoin back on a dining purchase etc

Point

PointCard – Visa – $99 AF

Currently tracking if this is worth the AF. Will have a dedicated page for this

Rewards

- 2x back on all purchases

- Occasional “Access” boosts like 5-10x on Costco, WholeFoods, Amazon etc

SUB

$100 for $1000 spend in 30 days

Credit Cards

Bank of America (BofA) Cards

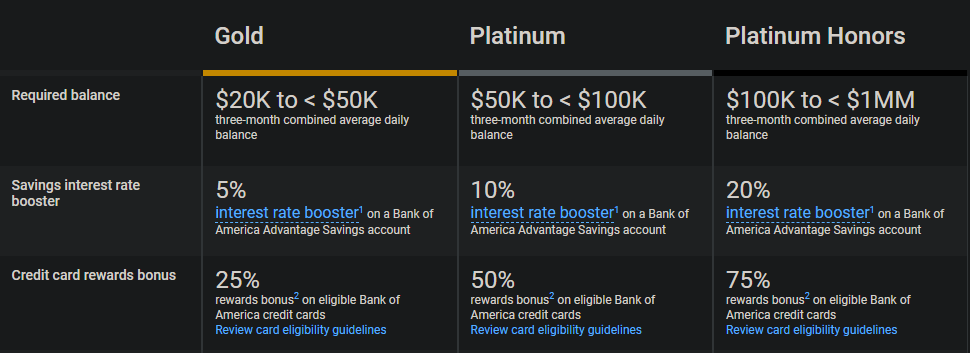

Bank of America cards are what I am focusing on as my long term credit card solution, centered around their Preferred Rewards system. Currently, I am a Platinum member and will slowly be moving towards Platinum Honors. I use BofA as my main bank and as my main brokerage (Merrill) which holds my personal brokerage and Roth IRA accounts. For a good writeup on this program, see DoC’s page on it.

Customized Cash #1 (Online Shopping) – Visa – No AF

The online shopping category is very broad. I use it for shopping, bill payments, travel if needed etc. Anything purchased on a website will trigger this (some exclusions)

Rewards

- 4.5% back on all online purchases (base 1% + category boost of 2% + preferred rewards boost of 50%). See what counts as an online purchase here.

- 3% back at grocery stores and wholesale clubs

- Both rewards capped at $2500 per quarter total

SUB

$200 for $500 spend

Customized Cash #2 (Dining) – MasterCard – No AF

This was my main dining card until I got the Cardless Boston Celtics card. Once I reach Platinum status I will use this as my main dining card

This card was originally an MLB Cash Rewards card but after BofA dropped MLB as their official credit card partner, it was converted to a Customized Cash card. Same rewards, just no longer Yankees branded 😦

Rewards

- 4.5% back on all dining purchases

- 3% back at grocery stores and wholesale clubs

- Both rewards capped at $2500 per quarter total

SUB

$200 for $500 spend

Premium Rewards – Visa – $95 AF

Now that I have the Venture X I will probably PC this to the new Unlimited Cash Rewards for the same cash back, minus the benefits and AF

Rewards

- 2.25x back on all purchases

- 3x back on all travel purchases

Benefits

- $100 annual “incidental travel” credit. This is intended to work for things like baggage upgrades, inflight purchases etc. I use it to purchase $100 AA gift cards once a year. See more info on this “loophole” here

- $100 credit for TSA Precheck/Global Entry (once per 4 years)

The credit can be used annually not once per AF period so you can use the incidental credit twice per AF, making this card a $105 moneymaker if you value AA gift cards

SUB

$500 for $3000 spend

Chase

Chase has their infamous 5/24 rule. This can be a good avenue for people who want to travel often as their higher end cards offer boosts similar to BofA’s Preferred Rewards boost but I value cash back more

Freedom (CF) – Visa – No AF

Rewards

- 5% quarterly rotating cash back (category history), max $1500/quarter

- 1% all other purchases

SUB

$200 for $500 spend

Sapphire Preferred (CSP) – Visa – $95 AF

I opened this card strictly for the SUB and plan on downgrading it to another Freedom (OG not the new Freedom Flex so I can get a FF in the future for the SUB)

Rewards

- 5x on travel purchases made on Chase Travel Portal

- 3x on dining and grocery

- 2x on travel

- 1x on all other purchases

Benefits

- 25% boost to rewards when redeemed towards Pay Yourself Back or travel portal

- $50 Anniversary Hotel Credit

SUB

$1000 for $4000 spend (redeemed through PYB for $1250)

Capital One

Venture X – Visa – $395 AF

Rewards

- 10x on hotels/rental cars purchased through Capital One Travel Portal

- 5x on airfare purchases through Capital One Travel Portal

- 2x on all other purchases

Benefits

- $100 anniversary credit

- $300 annual credit for purchased through Capital One Travel Portal

- Priority Pass

- Cell phone protection

- Price drop protection when purchased through Capital One Travel Portal

SUB

- 100,000 miles ($1000) with $10,000 spend

- First year $200 vacation rental credit (works for rent payments)

Citi

DoubleCash – MasterCard – No AF

I will probably PC this to something else now that I have the Venture X for 2x on all purchases now, undecided though

Rewards

- 1% back on all purchases

- 1% back on all payments made to the card

Premier – MasterCard – $95 AF

I opened this card strictly for the SUB and plan on downgrading it to a Rewards+

Rewards

- 3x on dining, gas, supermarkets, air travel, hotels

- 1x on all other purchases

Benefits

- $100 on a $500+ hotel stay made on thankyou.com

- Extended warranty of 2 years after manufacturers ends

SUB

80,000 points ($800) for $4000 spend

Synchrony

These were cards I opened before I ventured into the churning game. I still use them but if I knew then what I knew now I may not have opened them

Amazon Store Card – Store Card – No AF (Need Amazon Prime for full benefits)

I would suggest the Chase Amazon card over this card

Rewards

- 5% back on all Amazon purchases (including Prime and AWS)

Banana Republic – Visa – No AF

Rewards

- 5% back at the Gap family of stores

- 1% on all other purchases

- Rewards in the form of Banana Republic cash

Benefits

- 5-10% coupon for Banana Republic purchases

- Free shipping on Banana Republic websites

- Occasional spend bonuses (eg. make 5 purchases outside of Gap family of brands in a month for $20 in Banana rewards)

Discover

it – Discover – No AF

Rewards

- 5% quarterly rotating cash back (category history), max $1500/quarter

- 1% on all other purchases

SUB

Double rewards for the first year. I maxed this out for a value of $375 for $7500 spend (opened in the middle of a quarter)

Barclay

Something to note is Barclay waves all small balances on your card $1 and under. So if you leave your balance on the card at $1, they will credit you the $1 when your current cycle closes and your bill generates so you will not have to pay anything. Great for a $1 Patreon subscription or $0.99 iCloud subscription. More info here

View – MasterCard – No AF

~sigh~ this is a sad one. Originally this was an Uber Visa, which was a 4% back dining card with no AF. That was discontinued and changed to this useless card

Rewards

- 3x on dining

- 2x on grocery, internet, steaming, phone and TV services

- 1x on all other purchases

First National Bankcard Omaha (FNBO)

Ducks Unlimited – Visa – No AF

This card with this rewards scheme has been discontinued. I am grandfathered in.

Rewards

- 5% back on gas and sporting goods, uncapped

- 1% back on all other purchases

HMBradley (HMB)

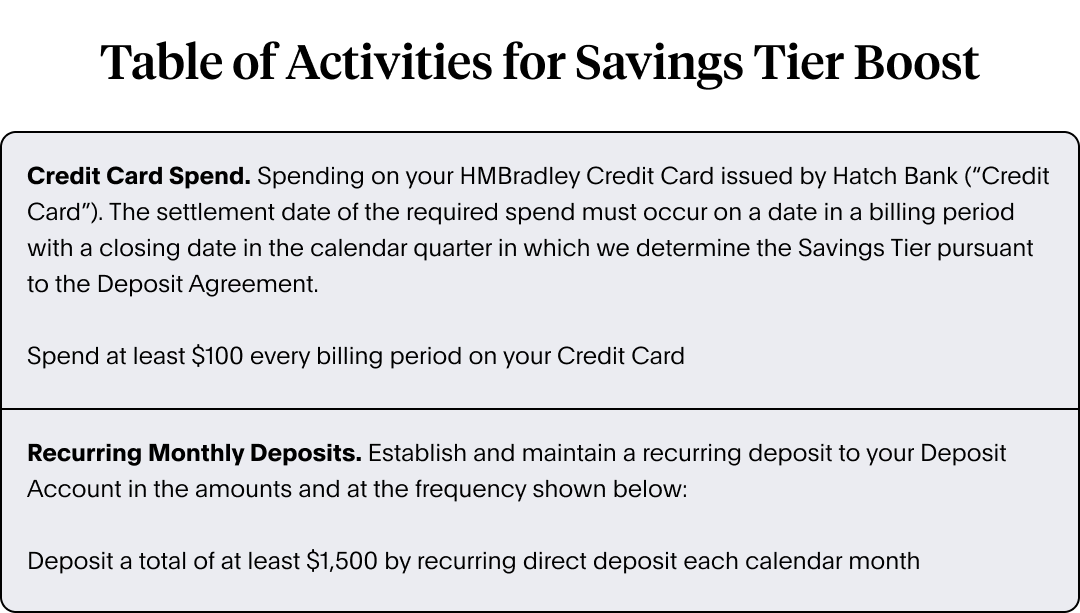

This card ties into the HMBradley ecosystem which provides certain benefits towards their deposit products. I will have a writeup about HMBradley soon

HMBradley – MasterCard – $60 AF

I mainly use this card for the top category or large purchases. I use the niche categories to maximize rewards

Rewards

- 3% back on your top spend category

- 2% back on your second top spend category

- 1% back on all other purchases

This card has weird/unique cash back categories which are detailed here

Benefits

- Payments do not count against your deposit account’s savings percentage

- Tier boost when you meet the requirements (higher APY on deposit account)

Workers Credit Union (Elan)

Elan is the parent company to USBank. Many credit unions offer credit cards through Elan. Their cards can be found here

Max Cash Preferred – Visa – No AF

This card offers 5% on two categories of your choice. It is essentially a clone of the USBank Cash+ card but with more lenient underwriting and more broad categories

Rewards

- 5% back on recreation and utilities, max $2000/quarter

- 2% on dining

- 1% on all other purchases

SUB

$150 for $500 spend

Cardless

Cardless is a new Fintech offering interesting cards in partnership with professional sporting teams

Boston Celtics – MasterCard – No AF

Rewards

- 10x on Celtics fanstore

- 7x on Celtics tickets & rideshare

- 4x on dining

- 2x on grocery & drugstores

- 1x on all other purchases

SUB

- $300 for $2500 spend

- One time $100 “Holiday bonus” for $1000 spend in ’21 holiday season

Leave a comment