Disclaimer: I am not a financial or tax advisor. This is not financial or tax advice. This is for entertainment purposes only. Enjoy!

Introduction

- What is bank account churning/bonuses?

Bank account churning is the act of opening up bank account with signup bonuses attached with the sole purpose of receiving the bonus

- Purpose of the Paper

- Educating readers about the basics of bank account churning.

- Try to convince you to open at least one bank a account to see how easy YOU find it

- Importance of Understanding Bank Account Churning

- Why it’s relevant for consumers and banks.

- Potential benefits and drawbacks for individuals.

Section 1: Understanding the Basics

What is a Sign-On Bonus?

Sign on bonuses typically have a few requirements for you to receive the bonus. Bonus language is precise, as consumer rights are heavily regulated by the CFPB (Consumer Finance Protection Bureau). Once you meet the set forth requirements, you will be paid out a lump sum or sums of money. An example of these requirements can be any of the following

- Direct deposit from your employer in the amount of $X (typically cumulative $500 or more in one month)

- Maintain a positive or specified balance (some savings bonuses require some deposits in the magnitude of thousands of dollars)

- Debit card transactions (complete 12 transactions in a month, for example)

- Keep the account open for X days (typically until the bonus has posted into the account but sometimes can be 6-12 months)

- Turn on electronic statements (eStatements)

Why banks offer sign-on bonuses

Banks know that once a customer opens a bank account with them and preform certain acts (direct deposit, debit transactions etc), these customers become “sticky” – they will be customers for life. To entice them to take the first step and open an account, they offer these sign up bonuses.

How Bank Account Churning Works

Bank account bonuses are plentiful as there are thousands of banks. Doctor of Credit (aka DoC) has a constantly updated list of current bonus available with their requirements and insights on how to meet them. The entire process involves: opening the account, meeting the requirements and avoiding fees (if any), receiving the bonus and finally closing the account. One thing to note – don’t take the terms of the offer on DoC as accurate. Always read the terms yourself and be sure you fully understand them

A note on terms

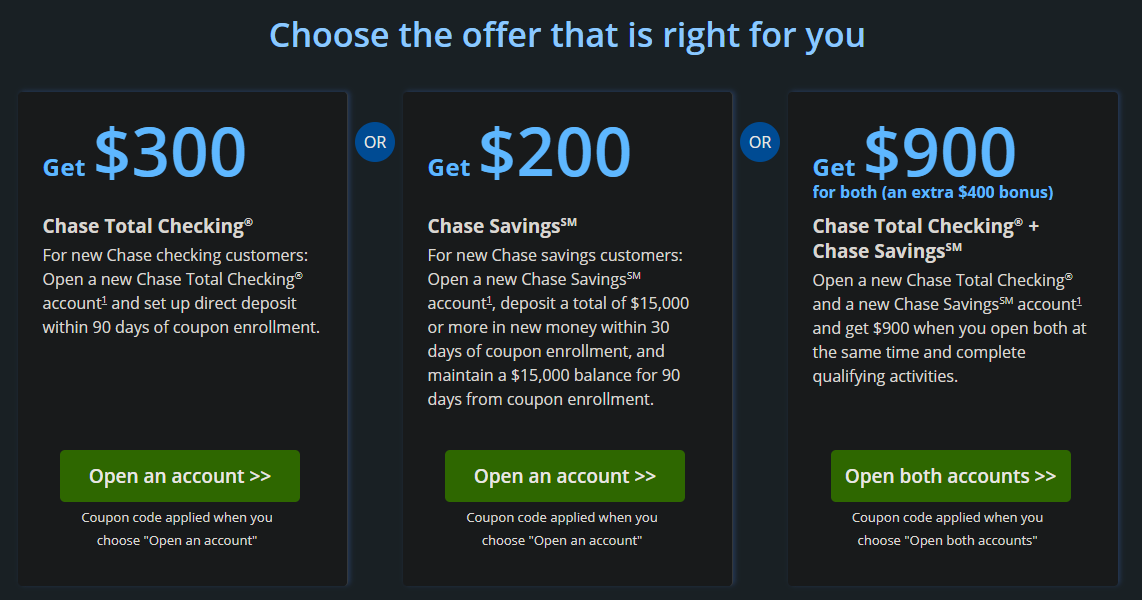

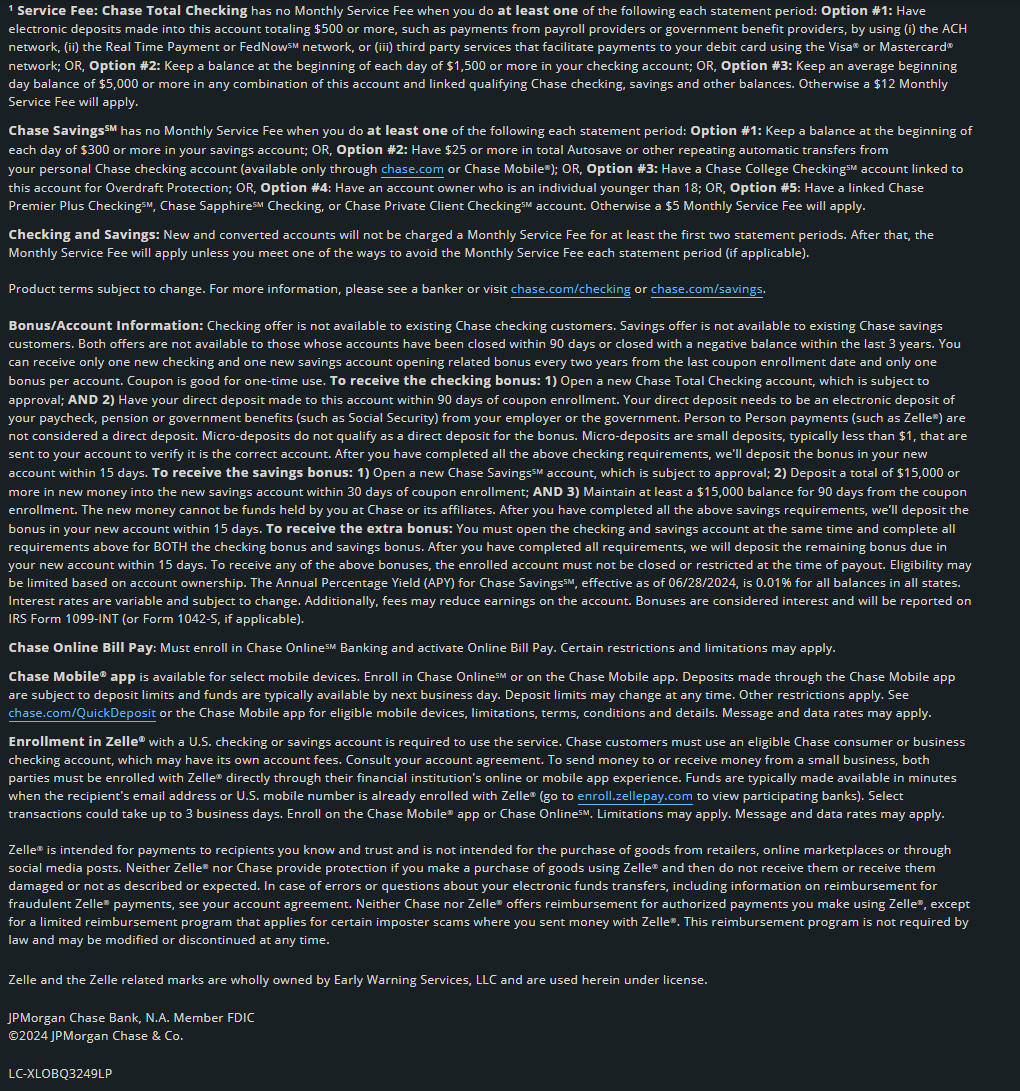

By terms, I don’t mean the flashy advertising the banks use for their bonuses like these

I mean the jargon that no one is reading at the bottom of the page – known as the fine print

Meeting Requirements

Requirements range from direct deposit, debit transactions, account balances or some other niche requirements. Let’s go over how you can meet them

Direct Deposit

Banks like direct deposits since they are sticky. Often banks require $X dd, sometimes requiring a certain number of direct deposits in addition to the monetary. Be sure to read the terms (you’ll hear this a lot) to see what exactly the terms state

- If it says cumulative, that means over the time period of the qualification period your direct deposits need to total that amount over that time in any amount of DDs to meet that requirement

- If it specifies a certain monetary value for each direct deposit, such as two $1k deposits in 90 days, two direct deposits, each in that amount, will meet the requirements

You can check DoC for what triggers banks DD requirement in this large post of theirs that is constantly updated.

Debit Transactions

Often banks like to see you use the debit card I think because getting consumers to use their cards will make it a habit. For these, I like to try debit card reloads (like Cash App) or small charges (like Amazon Gift Card balance reloads or buy a bunch of individual bananas)

Account Balances

These should be spelled out clearly in the terms. Usually there is a qualifying period where you need to meet the balance requirement, a holding period where you need to hold the funds, and then a payout date when you will get the bonus (sometimes this is not spelled out). Once I have satisfied the holding period, I normally withdraw all but maybe $50 and wait for the bonus to hit the account

Account Disclosures

When signing up for the account, and they tell you to read some documents, actually read them. You are looking for anything about the bonus or a fee schedule. In the fee schedule look for account closure fees, early termination fees, inactivity fees, low balance fees etc. Make note of these!

Section 2: The Pros and Cons of Bank Account Churning

Anything that sounds too good to be true normally is, so what is the catch? The main drawbacks to bank account bonuses/churning is the time and effort involved and the organization required to effectively pursue a bonus. Let’s break down the pros and cons

| Pros | Cons |

| Earn extra money (technically interest) for minimal effort (some bonuses pay out $200-$900 each) | Time and effort involved |

| Potential impact to credit score (avoid any account that performs a hard pull/inquiry on your credit report and you will get no impact to your credit score) | |

| Impact to your Chex score (credit score but for bank account – only downside is when you open dozens banks will deny you for new ones) | |

| Potential fees/missed bonus if terms are not followed (early account termination, minimum balance fee etc) | |

| Minimally more complex taxes (just receive 1099-INT and file it) |

Pros

Earning Extra Money

There are many bonuses, some we will discuss below, that truly are “no brainers” and “easy money”. Open the account, perform a direct deposit and receive your bonus. For tax purposes, these bonuses are considered interest earned and you are required to report the bonus as income. Most banks issue 1099-INTs for their bonuses, but IRS regulations do not require them to send you one if your interest earned was under $10 (updated HT BossChecker). However, just because you did not receive a 1099-INT does not mean you do not have to report it. Consult a tax professional. This is not financial or tax advice.

Cons

Time and Effort Involved

Reading the terms, applying, tracking and meeting the requirements, receiving the bonus, closing the account and reporting your interest during tax season all may come easy or hard to some. It requires decent organization skills and bookkeeping. The effort is minimal but there is effort required. I would estimate a few hours spent for a bonus over the time of the bonus is to be expected

To make tracking easier, I have added a starter SUB tracking spreadsheet to my Patreon. It is very basic and has fields such as bank, account type, date opened, closed, date bonus received etc.

Potential Impact to Credit Score

Most do not but some banks/credit unions pull your credit report when you open an account which will impact your credit score. If you do not want this, avoid those banks/credit unions

Impact to your Chex score

Some banks report to and use Chex to see your bank account worthiness – similar to a credit score for banks. This score is only used when applying for new bank account so if you open a few accounts in a year you should not see any issues with opening new accounts in the future

An additional thing to think about is the ethical implications. While you are not violating any laws or terms and conditions of the banks at which you are opening these accounts, opening and closing the account after receiving the bonus is not what the bank intended when they offered the bonus. A good rule of thumb is to wait a few months after receiving the bonus as to not bring attention to your true intent. The banks understand that some “gamers” will open accounts just for the bonus – just keep in mind your actions

Potential Fees/Missed Bonus if Terms are not Followed

Some accounts have fees that will be assessed if certain requirements are not met. Some potential requirements include minimum balance, a paper statement fee, early account closure fee, inactive account fee etc. These will all be clearly laid out in the bank/CUs Fee Schedule available on their website. Some accounts have no fees – DoC outlines this in every bonus details. This is where bookkeeping comes into play. Make note of important fees for every account you open to avoid them

Do keep in mind, if you wind up paying $10 in fees but made a $300 bonus, you are still making $290 on the bonus

Section 3: Strategies, Tips & Advanced Points for Churning

- Planning and Research

- How to find and compare offers (mention DoctorOfCredit.com as a resource).

- Understanding the terms and conditions.

- Read them yourself, do not rely on DoC’s coverage as it is sometimes inaccurate or out of date

- Determining which are “easy”

- Can you do $1k in DD per month?

- Be able to float your DD for a few weeks while you satisfy the bonus since it is not in your pay from account

- What to do when you receive the bonus

- Check DoC for Data Points

- Unsure what triggers a DD or debit requirement? Check the DoC comments on the bonus!

- Managing Multiple Accounts

- Keeping track of requirements and deadlines.

- Patreon for a starter burning tracking spreadsheet

- Avoiding common pitfalls (inactivity fees, early account closure fee)

- If there is a promo code for the bonus, be sure to add it!!! It should be somewhere during your application. If you forget it, no bonus for you!

- Keeping track of requirements and deadlines.

- Entering Account Info Correctly (ht bleakchoochoo)

- $1 DD to test

- I do it so often now it’s like second nature but I get it! I believe most clearing houses (payroll payers) will return the funds and reach out if you fat finger the account and the account doesn’t exist

- To avoid this, pull up your account in a window besides where you are updating your DD. Copy your account number and paste it in. Also, you can search on the page (control or command F) and search for your exact ACH number to ensure it is correct (HT bleakchoochoo)

- Follow the terms exactly

- Pop quiz! Let’s look at this easy Chase bonus, read the terms, and determine the requirements and what the important parts are

- Tracking is important!

- Some bonuses are churnable, as in you can do it multiple times. Often they require you to wait X months from when you opened, closed, or received the bonus last. If you want to get more into this, I advise tracking these things!

- I received my bonus! Now what?

- Some accounts have an early account closure fee, some have clauses in the terms of the offer that they will revoke the bonus if you close early. What I like to do is in my spreadsheet for the bonus, under close date I put the future date for when I would be eligible to close without losing the bonus, then I round to the next month. This way, if I somehow miscalculate I have a buffer

- I usually am lazy and forget to close. Thankfully most account don’t have inactivities fees or if they do they are 12+ months

- Oh no! I was charged a fee on my account. What should I do?

- It’s ok! Call the bank and explain it was a mistake and if it could be waived. Most will! If not, remember you will probably still be profitable!

- I haven’t received my bonus, what should I do?

- Double check that you actually have met the requirements. Now triple check

- Call the bank and explain you signed up using a promotion and believe you met the terms. Have the DoC article for reference or your notes but DON’T say you used DoC and DON’T be rude! You are getting free money, be cordial and kind

- If you truly did not receive the bonus and are confident you met the requirements, file a CFPB complaint. Banks are legally required to respond. I have used this in the past to get paid when I was owed. This should be a break glass option as a last resort

Section 4: Risks and Considerations

- Impact on Banking Relationships

- How frequent account opening/closing can affect your relationship with banks.

- Possibility of being blacklisted or restricted from promotions.

Conclusion

I truly think the average person can supplement their income with at least $1k every year in bank account bonuses with minimal effort – ESPECIALLY if they have access to an easily updatable direct deposit. This year I have opened 19 accounts with the purpose of getting some kind of bonus or benefit from it and that has awarded me with $3,977.33 in bank account bonuses this year with $1,150 currently in flight.

Lifetime bank account bonuses are to the right and quite lucrative but not attainable for most. I’d target one to start, see how you like it and slowly ramp. I like to do real DDs and not test ACH pushes to satisfy the requirements if I can avoid it. I mostly go for DD centered bonuses as mine is very easy to change and bi-weekly

Leave a comment