Today we will be discussing Enzo, a new fintech with some unique cash back offerings. They plan on expanding their offerings in the future to have more compelling features other than just unique cash back categories but for now we will be discussing what they do offer

Currently, Enzo offers a checking account with unique cash back offerings that is seldom seen from any other product in the market. In this post I will go over their offerings, the requirements that come with them and how to use the cash back

Most of the information found on this page is sourced from Enzo’s Terms of Service page

There is now an official support page made by Enzo explaining the process here

Benefits

Interest

Interest is current set at 0.5% for the account. Just like 3.6 Roentgen, not great not terrible. Interest is paid on the 1st of every month

Unique Cash Back

All cash back is awarded in one lump payment on the 5th of every month for the previous month. They are working to make this instant but is probably months away IMO

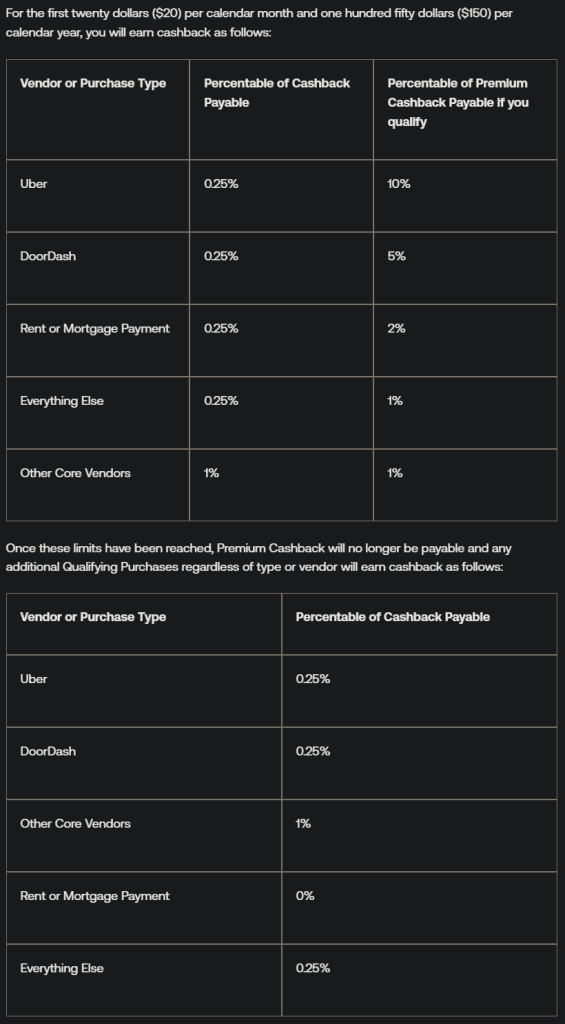

I am going to break down the above tables but you can find this and all the info in their terms

Of note, the max total cash back between both of the following categories is $2500. So if you max out the Premium Cash Back at $150, you have $2350 left for the standard cash back

Premium Cash Back

Enzo, after meeting requirements which I will get into later, offers the following cash back. The cash back earned is capped at $20 per month and $150 cumulative for all of these categories. They call this their “Premium” cash back

- Uber: 10%

- DoorDash: 5%

- Rent/Mortgage Payment: 2%

- Everything Else: 1%

- PayPal (called “Other Core Vendors”): 1%

In their terms, they referrer to “Other Core Vendors” and define a list of vendors that fall under this. Currently only PayPal is listed but presumably it was written this way to allow for expansion of the group in the future

Once you reach the max cash back for the month/year, you will continue to earn rewards but at the “Standard Cash Back” rate described below

Of note, all cash back requires use of the debit card except for the rent/mortgage payment. That can be done via ACH or debit payment

Requirements

In order to qualify for Premium cash Back, you must meet one of the following two requirements

- Qualifying Direct Deposit >= $1500 per month

- Average Monthly Balance >= $2000

The $2000 balance is what I will be meeting to qualify for the cash back since I will be making high volume transactions in this account anyway. I will probably set up an Astra routine to keep me pegged at $2k

Standard Cash Back

Standard cash back has no requirements and are available to all customers. These have an annual limit of $2500 cash back earned. The rewards are as follows:

- PayPal (called “Other Core Vendors”): 1%

- Everything Else: 0.25%

- Rent/Mortgage Payments: 0%

You will notice that Other Core Vendors are listed in both categories. This is because whether you don’t meet the Premium Cash Back requirements, or you have met your Premium Cash Back limit, you will still earn 1% on those purchases

Use Cases

Rent/Mortgage Cash Back

Enzo handles this cash back uniquely. This payment can be made using both the debit card and an ACH transfer, making this much more usable when compared to something like Bilt since most companies charge when you pay with a debit card. With Enzo, you can pay directly with an ACH transfer and earn cash back through that

Currently this cash back must be flagged manually in the app. It’s easy to do but you have to obviously remember to do it each month. They do have a support article on how to flag the transaction here

PayPal Cash Back

This may seem really uninteresting but there is a unique feature in PayPal that actually makes this really compelling (credit to simsimo47 for bringing this feature to my attention)

PayPal offers a bill pay service that allows you to pay your bills (credit cards, utilities etc) fee free. In addition, PayPal lets you pay for some/most of these bills via a debit card. So, you can pay for your credit card using PayPal Bill Pay with your Enzo debit card and earn 1% on the payments, fee free.

PayPal Bill Pay (Pay your bills) can be seen when selecting the ellipsis in the top right on desktop web.

PayPal Bill Pay can be found in app under the $ tab at the bottom, then the “Bills” tab at the top

This is not all unicorns and rainbows unfortunately. I personally love using autopay for my credit cards so I don’t have to remember to pay them every month (especially since I have 15 cards) but PayPal does not offer this. They are not a bill pay like most banks offer where they receive your bill and send the exact payment to the card issuer on your behalf; PayPal Bill Pay is completely manual. You can however schedule a payment

I personally only have three of my cards going through this pattern. These are my BofA cards mainly because they don’t offer auto pay and BofA makes it very difficult to make payments to their cards from an outside bank. When my statement generates I schedule the payment for before my due date via PayPal Bill Pay and repeat every month.

This cash back is automatically tracked

Important note: PayPal Bill Pay takes around a day after the scheduled date to show up on the card as a payment so keep that in mind. It could also take longer, especially due to bank holidays or weekends

Other Cash Back

All other cash back is automatically tracked and work as expected. Not much to note here. Not sure if buying Uber Cash or DoorDash credit would trigger the cash back but give it a try and report back if you want!

Conclusion

Enzo has some really great value propositions, mainly in their PayPal/Mortgage cash back at the moment. Although keeping $2k in a 0.5% APY account is a bit sub par the benefits work out to be worth it.

Even if you were earning 4% on that balance elsewhere, if you earn the max of $150/y in the Premium Cash Back category, you would still net $80. That $80 was calculated by

- Premium Cash Back Max = $150

- Enzo Interest = $2k @ 0.5% APY for 1 year $10 = $2k * 0.005 = $80

- Opportunity Cost of $2k @ 4% APY for 1 year = $2k * 0.04 = $80

- Total Added Value = $150 + $10 – $80 = $80

The break even point would be earning $70 in premium cash back. If you only utilized the rent/mortgage cash back in that category, that would be $3.5k worth of rent/mortgage payments

The above calculations are not even considering the PayPal Bill Pay benefits. There are no requirements there so there is no opportunity cost, only the time you keep the bill pay amount in Enzo before making the payment

Overall I say give Enzo a shot. Their CEO Jeremy Shoykhet is very nice and active on Discord and DoC. I am excited to see what else they may offer in the future!

Fellow blogger Evan also wrote an article on Enzo here, check it out!

Leave a reply to Current Bank Accounts – Personal Finance Cancel reply