Another year, another spend analysis time! Year over year I make iterations to how I track things. Small improvements, new metrics, better tracking etc. Some improvements include using RocketMoney to get my spend on my Future card (previous done manually) Well break down YoY, see how my cash back is progressing and even look at my top cards for each category. How fun!

If you haven’t read my 2023 and 2022 Spending Recaps, they can be found here

Disclaimer: I find being transparent about finances to be valuable so these are my actual metrics. I am not doing this to brag in any way. I just hope that my insights can somehow help other and help myself be smarter about my money

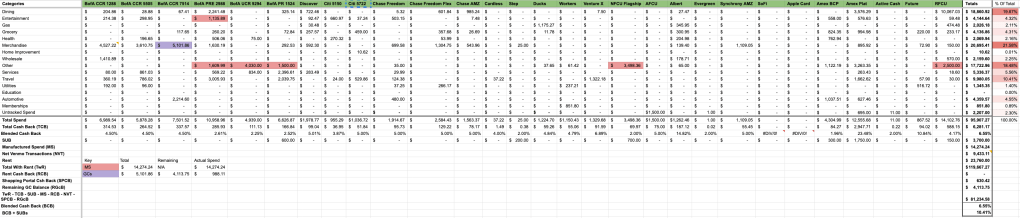

The Totals

2024 Spend Recap Spreadsheet

2023 Spending Recap Spreadsheet

2022 Spending Recap Spreadsheet

2021 Spending Recap Spreadsheet

Once again, if all you care about is the raw numbers, you can stop reading. The rest of this document will go into a breakdown of each category, some notes I have about each and finally a comparison to how this year stacked up against last year

| Year | Total CC Spend | YoY | Total After All Deductions | YoY |

|---|---|---|---|---|

| 2024 | $95,907.27 | 21.05% | $81,234.58 | -4.29% |

| 2023 | $79,228.46 | 0.45% | $84,689.10 | 3.52% |

| 2022 | $78,870.91 | – | $81,812.95 | – |

Year over year I normally spend the same but this is the first year I am seeing a new trend! While total credit card spend rose a whopping 21%, that doesn’t tell the full story. After all deductions, my total real spend went DOWN over 4%!

When I first started this year’s sheet I was quite worried looking at the total CC spend. But after calculating all deductions I felt much better and honestly proud! Although my income went up YoY, my spend went down!

Asterisks

Wanted to give some asterisks behind this data before we dive in

Cash Back is Estimated

Most of my banks issue some form of year end summary but none of them offer the same for cash back. To calculate cash back, I do rough estimates based on. categories and what I use the cards for. For example, I assume a flat 5% for cards like the Citi Custom Cash and Chase Freedom/Flex because I always optimize my spend to only be on these cards when they will earn 5%. Some cards are accurate like all of my BofA cards (earning 4.5% on everything through Online Shopping & Curve or 2.25% straight cash back), Atlantic Federal Credit Union (5% up to $200/m), Albert (manually tracked) and others

Lots of Spend Reimbursed

You will notice Net Venmo Transactions (NVT) as a line item. This is spend I made but was reimbursed from friends/family for. Most of these transactions, I retain the cash back but sometimes on larger purchases I will send them a cut/all of it. This cash back is still counted in my totals even though I may have paid it off

Bank Account Funding (BAF) has been renamed to Manufactured Spend (MS)

The large uptick in CC spend that is not present in the true total spend is mainly due to bank account funding but felt it was clearer if I just called it MS as that is what it is. These are signified in red in the key and table

Remaining GC Balance (RGcB)

With the onslaught of Pepper gift card deals I felt the need to track these separately. You will see a color legend for gift card purchases (purple) and see that color in the table. I went and tracked how many of those GCs were used and which I have outstanding balances for. If they have an outstanding balance. I didn’t consider those spend since I still hold the value. Accountants hate me!

MCC Dependancy

All of these categories are taken from MCCs from the transactions. These can not only be wrong but can vary from network. I know that some automotive spend leaked into other categories but eeteeswhateetees

Spend by Category

Dining

| Year | Spend | % Of Total | YoY |

|---|---|---|---|

| 2024 | $ 18,860.92 | 19.67% | 39.46% |

| 2023 | $13,524.65 | 17.07% | 18.43% |

| 2022 | $11,419.88 | 14.48% | – |

Dining includes things like restaurants, fast food, bars and other specialty food restaurants. This is quite the large uptick from last year. I attribute this to going into office more (I never bring lunch) and always putting my card down when splitting going out with friends.. Most of the reimbursements I receive are usually for dining purchases, and I think we spent less on my cards while traveling so most of my Venmos were for dining

With the addition of the RFCU Visa, that has become my de facto dining card, dethroning the Cardless Boston Celtics card which now has no purpose in my repertoire

Entertainment

| Year | Spend | % Of Total | YoY |

|---|---|---|---|

| 2024 | $ 4,144.64 | 4.32% | 8.95% |

| 2023 | $3,804.14 | 4.80% | -40.97% |

| 2022 | $6,444.68 | 8.17% | – |

Things kind of remained the same here. A few concerts, sporting events etc. Not much to write home about

Most of my spend here goes to one of my Citi Custom Cash Cards but this year I added some spend to the Chase Freedom when it was Entertainment and the Amex Plat to get some offers and hit MSR

Gas

| Year | Spend | % Of Total | YoY |

|---|---|---|---|

| 2024 | $2,026.18 | 2.11% | -22.12% |

| 2023 | $2,601.55 | 3.28% | 15.45% |

| 2022 | $2,253.31 | 2.86% | – |

Still driving to the office but I think in general gas prices went down. I don’t think they went down 22% so I think I may just be driving less. I am also supplement my SUB for motorcycle driving which is much more fuel efficient

My spend is slowly making it’s way from my grandfathered Ducks Unlimited card to my RFCU Visa. Both earn 5% on gas but I am just lovin the RFCU card. Very little spend on Albert as I let that ship sail shortly after Curve went bye bye

Grocery

| Year | Spend | % Of Total | YoY |

|---|---|---|---|

| 2024 | $4,136.86 | 4.31% | -12.58% |

| 2023 | $4,732.11 | 5.97% | 115.67% |

| 2022 | $2,194.17 | 2.78% | – |

As I was last year, I am surprised by this once again. I don’t really do mealkits anymore but I guess it explains why my dining out is much higher – I am buying less groceries! I do always have fresh berries in the house but a local grocery store has crazy deals on the weekend so I only spend ~$20 for a week of ’em

This year lots of my spend went from the Discover card to the Amex BCP. Once that AF is due I will downgrade and go back to my Citi Custom Cash or rotating cards for this. Albert is gone for me so not used much here

Health

| Year | Spend | % Of Total | YoY |

|---|---|---|---|

| 2024 | $2,069.94 | 2.16% | -3.47% |

| 2023 | $2,144.42 | 2.71% | 109.11% |

| 2022 | $1,025.48 | 1.30% | – |

Seems like this spend is the new norm. I sprained my ankle this year so a few specialists here and there got us here. I have a PPO so most of my spend is OOP

Most spend went to Amex cards for MSRs as opposed to Chase Freedom Flex and Albert in the past

Merchandise

| Category | Spend | % Of Total |

|---|---|---|

| General Merchandise | $20,695.41 | 21.58% |

| Home Improvement | $10.62 | 0.01% |

| Wholesale | $2,159.60 | 2.25% |

| Gift Cards | 5,101.86% | 5.32% |

| Total Merchandise | $22,865.53 | 23.84% |

| Year | Spend | % Of Total | YoY |

|---|---|---|---|

| 2024 | $22,865.53 | 21.58% | 9.97% |

| 2023 | $20,793.03 | 26.18% | -41.69% |

| 2022 | $27,436.72 | 34.70% | – |

This category is quite broad but I have done a better job of breaking them down into Wholesale and Home Improvement. Excluding gift cards, the total spend was actually $17,763.67 which I am happier about, considering $4k of those are unused

This year I got into record collecting/selling which is not a cheap hobby (see Discogs here). My collection is probably where a good potion of this spend is from. Also I spent a whopping $1k at meh.com this year. Also part of this spend is from Social Casinos which is MS

BofA Customized Cash Rewards are still the unsung hero here for Online Shopping. Also moved some spend to Amex cards again for MSR

Other

| Year | Spend | % Of Total | YoY |

|---|---|---|---|

| 2024 | $17,722.96 | 18.48% | 259.80% |

| 2023 | $4,925.76 | 6.22% | 134.40% |

| 2022 | $2,101.47 | 2.66% | – |

Unlike years past, ~66% of this is MS from bank account funding! This year was huge for MS for me which helps explain the inflated CC spend

Services

| Year | Spend | % Of Total | YoY |

|---|---|---|---|

| 2024 | $5,336.37 | 5.56% | -13.35% |

| 2023 | $6,158.47 | 6.22% | 20.71% |

| 2022 | $5,101.70 | 6.47% | – |

This includes tax payments which amounted to almost $3k. Churning bank account SUBs are expensive! I think I also paid for my Mom’s taxes last year and she paid me back

Travel

| Year | Spend | % Of Total | YoY |

|---|---|---|---|

| 2024 | $9,980.05 | 10.41% | -26.70% |

| 2023 | $13,615.22 | 17.18% | 48.10% |

| 2022 | $9,193.22 | 11.66% | – |

This year I went to Europe again and went to a few weddings but overall the spend went down I will attrribute this to me getting my travel buddies their own no FTF cards so they didn’t have to use mine and pay me back!

Utilities

| Year | Spend | % Of Total | YoY |

|---|---|---|---|

| 2024 | $1,345.35 | 1.40% | -32.53% |

| 2023 | $1,993.85 | 2.52% | 26.63% |

| 2022 | $1,574.50 | 2.00% | – |

I moved out of a poorly insulated mill building to an equally poorly insulated duplex in 2023 with gas heat and wall unit AC. But now that I am more accustomed to how to keep the place at a reasonable temperature I was able to cut back on the spend a bit

Automotive

| Year | Spend | % Of Total | YoY |

|---|---|---|---|

| 2024 | $4,359.57 | 4.55% | 4867.04% |

| 2023 | $87.77 | 0.11% | -97.15% |

| 2022 | $3,076.91 | 3.90% | – |

I remember calling this out as something to keep my eye on and I was right! Although 25% of that was spent on a family members car, my spend on my 2014 Jeep Cherokee is definitely trending upwards, in addition to maintenance on my motorcycle. Last years numbers are wrong due to bad MCCs – I probably spend ~$2k last year on a new drive shaft and standard maintenance

Memberships

| Year | Spend | % Of Total | YoY |

|---|---|---|---|

| 2024 | $851.80 | 0.89% | -19.84% |

| 2023 | $1,062.60 | 1.34% | -14.89% |

| 2022 | $1,248.45 | 1.58% | – |

Found a way to get a good discount on my rock climbing gym and purchased punch passes to the gym in my home town in 2023 which I am still using. Spend went down!

Untracked Spend

| Year | Spend | % Of Total | YoY |

|---|---|---|---|

| 2024 | $2,207.00 | 2.30% | -41.69% |

| 2023 | $3,784.89 | 4.78% | -25.79% |

| 2022 | $5,100.13 | 6.47% | – |

This is going down due to my lower usage of AFCU since they got rid of their Kasasa account and other various cards I only opened for SUBs in 2023

Takeaways

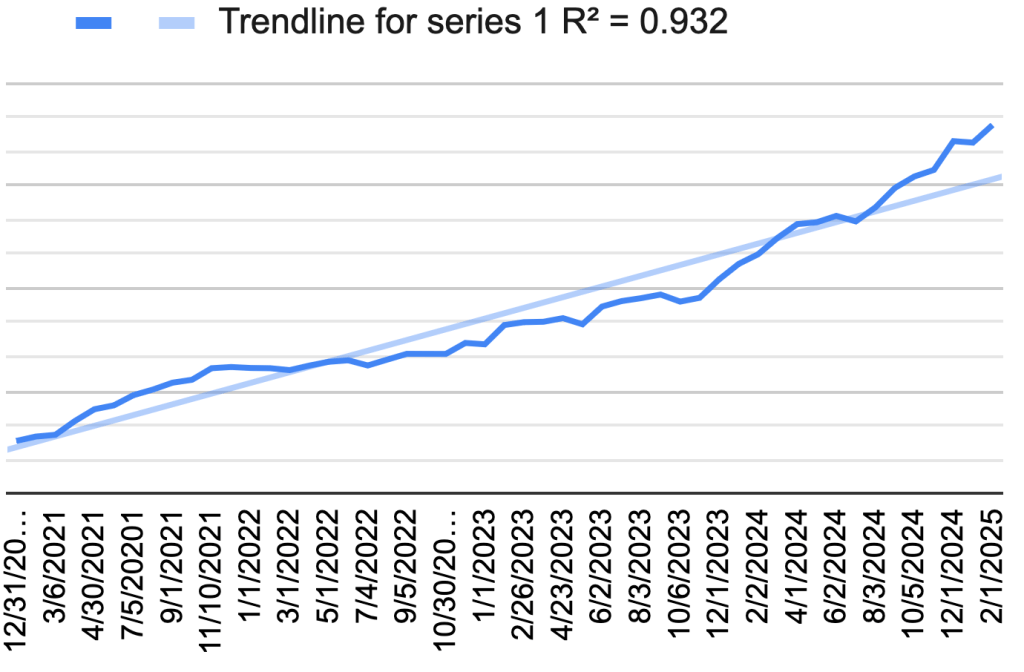

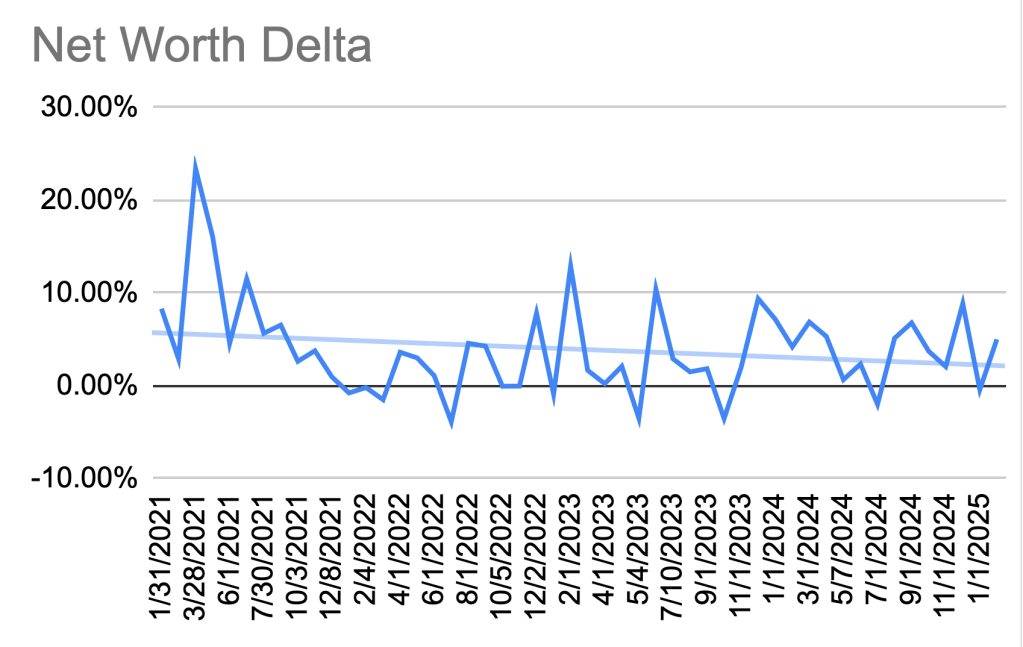

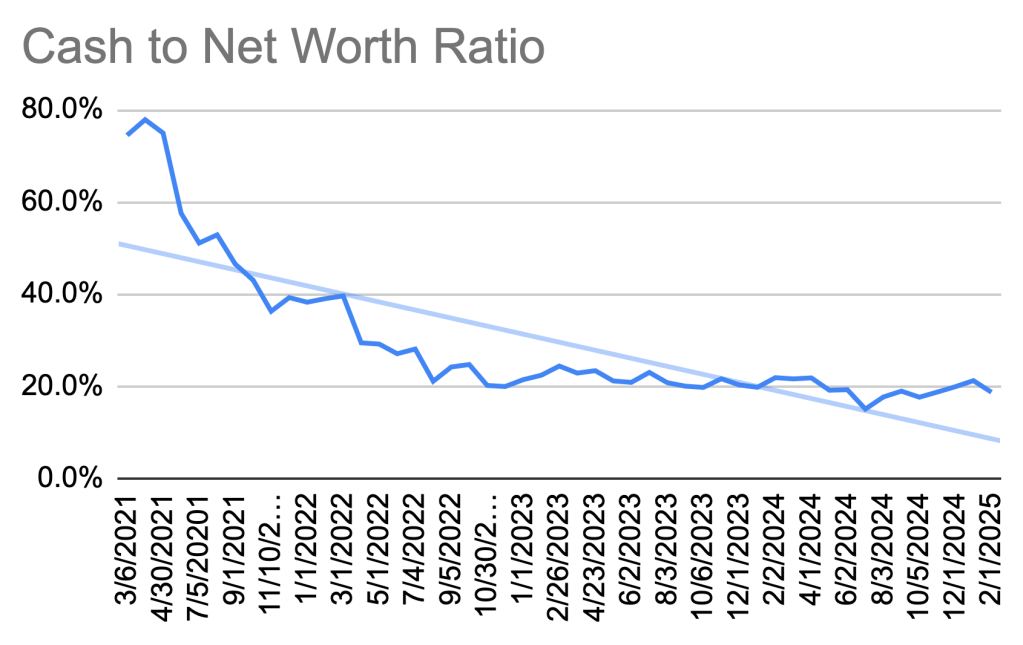

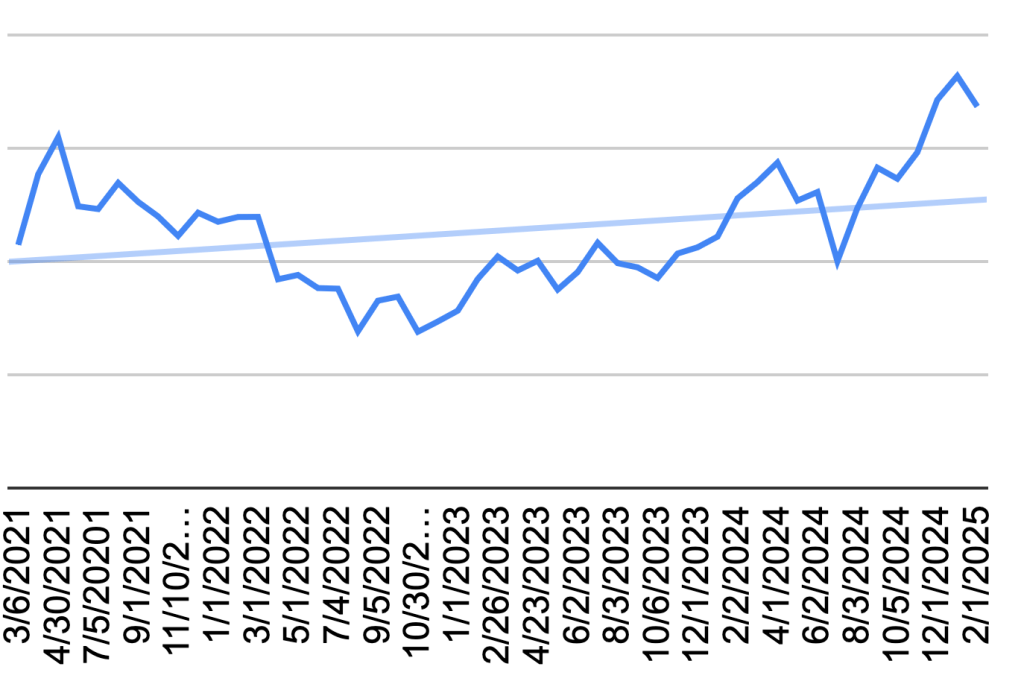

It is kind of crazy to see how much I spend in a year. I do want to say that every year I am maxing out my 401k, IRA and HSA and am dumping funds into personal brokerage and HYSAs to save for a house, so it’s not like my net worth is not growing. As a matter of fact, that is something I track on a monthly basis and will include some screenshots of those graphs for those interested

I noticed that from 2023 to 2024 my Net Venmo Transactions (NVT) remained almost identical. That was quite shocking and qhat a coincidence (also thank god for Rocket Money, manually tracking this SUCKED)

Also of note, my main job’s salary has increased ~15% since the start of 2024 so I am outpacing the growth of my spend in income. That also does not include the income from the kind Patrons of the Podcast, Discogs income (very minimal) and other MS avenues

I like to think of myself as financially savvy – I know how much I make, spend, save etc. I think I am in a great financial position but always looking to improve wherever I can and spending less is probably one of those areas

Graphs

Final Notes

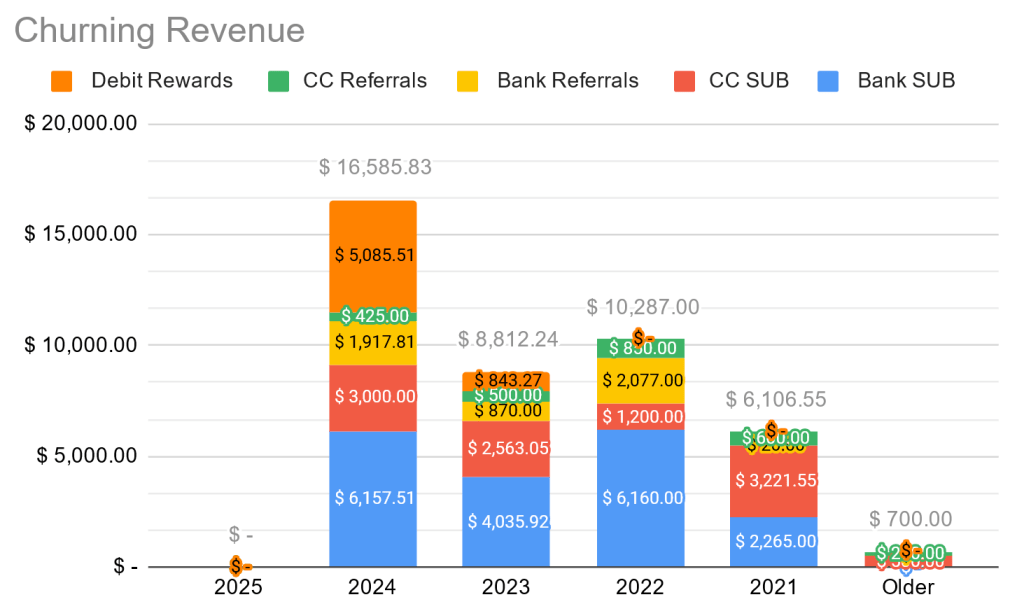

I hope you find this interesting! If you have any advice on how I can make this better or want more info on my spreadsheets please reach out, contacts on the footer as always. I will leave you with my final Churning totals for 2023 and years past. Thank you for reading and your support, it means the world ❤

Below is taken from my original post in 2022 but I felt it was worth adding here again

Spaghetti Soup

What exactly is that bottom line? That is Total Spend with Rent – Total Cash Back – Sign up Bonuses – Rent Cash Back – Net Venmo Transactions – Shopping Portal Cash Back – Manufactured Spend – Remaining GC Balance. This gives us our Non-Manufactured Spend (NonMST) total

The Tracker

This is my third edition of the tracker. The first one was much more rudimentary. The second one was very similar to this years but had estimates for CC rewards tracking. For 2022 I went through each card and calculated the cash back I earned for each of the categories.

Getting Spend Totals

To populate the tracker, some of it is done by hand but most of it is pulled from the CC companies. In my experience, banks handle end of year spend summaries in three different ways

- Downloadable Transactions Spreadsheet: Banks like Chase, Citi and Elan allow you to download csv’s of your transactions for the entire year. These are the easiest and most manipulatable as they are already in a spreadsheet and contain merchant categories on each entry. This way I can do some sheets magic to group by matching category and add up my spend for that category

- PDF Year End Summary: Banks like Bank of America, Capital One, FNBO and Discover issue a Year End Summary in the form of a PDF. This is the second best way for me to get this data. I can’t just copy-paste it into my spreadsheet but I can copy over how they divided up my spend into categories and try to match it to the other banks categories

- Manual Aggregation: Smaller banks like Albert, Venmo (P2P not card), Oxygen, Cardless and Atlantic Federal Credit Union (AFCU) do not offer either of the above two options. This requires me to go through all of my statements for them and manually account for all of my spend, what category it was in and how much cash back I earned on them. This is mostly a labor of love

Other Values

After completing all of the CC tracking, the total spend number was honestly surprising. I then went into thinking of how this number could artificially inflated. This is why I added my Net Venmo Transactions (NVTs). This is the total amount of money I received from friends and family repaying me for things I purchased for/with them on my cards. I have additional money I got via Zelle but I could not find an easy way to gather that data so I just left it

Rent cash back is from Enzo’s $20/m on my rent payments. I also got into cashback portals, mainly MealKit purchase, which you can read a bit more about here

Leave a reply to Episode 57: Shutdowns, Bonus Payouts & More – Personal Finance Cancel reply